A living wage is different than the provincially mandated minimum wage as it reflects the cost of living and is not legislated, but something progressive organizations commit to implementing to benefit their workers, their bottom line, and the local economy.

A living wage is an important poverty reduction tool to help get Niagara residents out of severe financial stress by providing the means to raise children and participate in social and community activities. The living wage reflects what earners in a household need to be paid based on the actual cost of living and being included in a specific community. A living wage is different than the provincially mandated minimum wage as it reflects the cost of living and is not legislated, but something progressive organizations commit to implementing to benefit their workers, their bottom line, and the local economy.

Major expenses that workers face, such as shelter costs, transportation, childcare, and food, are used as indicators to calculate the living wage. Other expenses are also considered, such as internet access, a modest annual vacation, and clothing. Any applicable government taxes, transfers, and benefits are factored in as well, and what is produced is an hourly wage that a worker must earn to make ends meet where they live. If an employer offers benefits, the current living wage rate can be altered based on the employer’s benefits plan. For more information about this process, please contact Anne Coleman, Program Manager at manager@ontariolivingwage.ca.

This hourly wage is updated annually to consider living expense changes and changes to government transfers and deductions. The new calculation is publicly released every November. This calculation assumes that employees work 35 hours a week for 52 weeks. However, all employees working for a certified living wage employer should be paid a living wage-this includes directly employed (full-time and part-time), contracted, and subcontracted staff. Trainee positions, such as student interns, student co-op placements, and trainees are not required to be paid a living wage.

In 2022, The Ontario Living Wage Network (OLWN) moved to a regional system regarding the updating of living wage rates. There are ten regions included in the Ontario Living Wage calculation. Niagara Region falls under the Brant-Niagara-Haldimand-Norfolk region. The rate for this region for the 2022-2023 year is $19.80.

To certify as a living wage employer, decision-makers can express interest by visiting www.ontariolivingwage.ca/certify and filling out the contact form. The manager of the OLWN employer program will then contact the decision-maker and discuss certification details and answer any questions. Interested employers are required to fill out an application and submit to the Program Manager. Once the application is reviewed, the manager will contact the employer to determine the implementation plan of the Living Wage Program. Interested employers are required to determine their level of recognition within the program.

The levels of recognition are:

- Supporter Level: All direct full-time employees are paid a living wage. Committed to begin raising the pay of all direct part-time employees to the living wage rate.

- Leader Level: All direct full-time and part-time employees are paid a living wage. Committed to including living wage in service contracts for externally contracted (third party) employees that provide service on a regular basis are paid a living wage.

- Champion Level: All direct full-time and part-time employees are paid a living wage, and all externally (third party) contracted staff that provide service on a regular basis are paid a living wage or will be when the contract renews.

Employers are able to start at the supporter level, and plan to reach Champion level over a course of time. This plan can be discussed with the OLWN Program Manager.

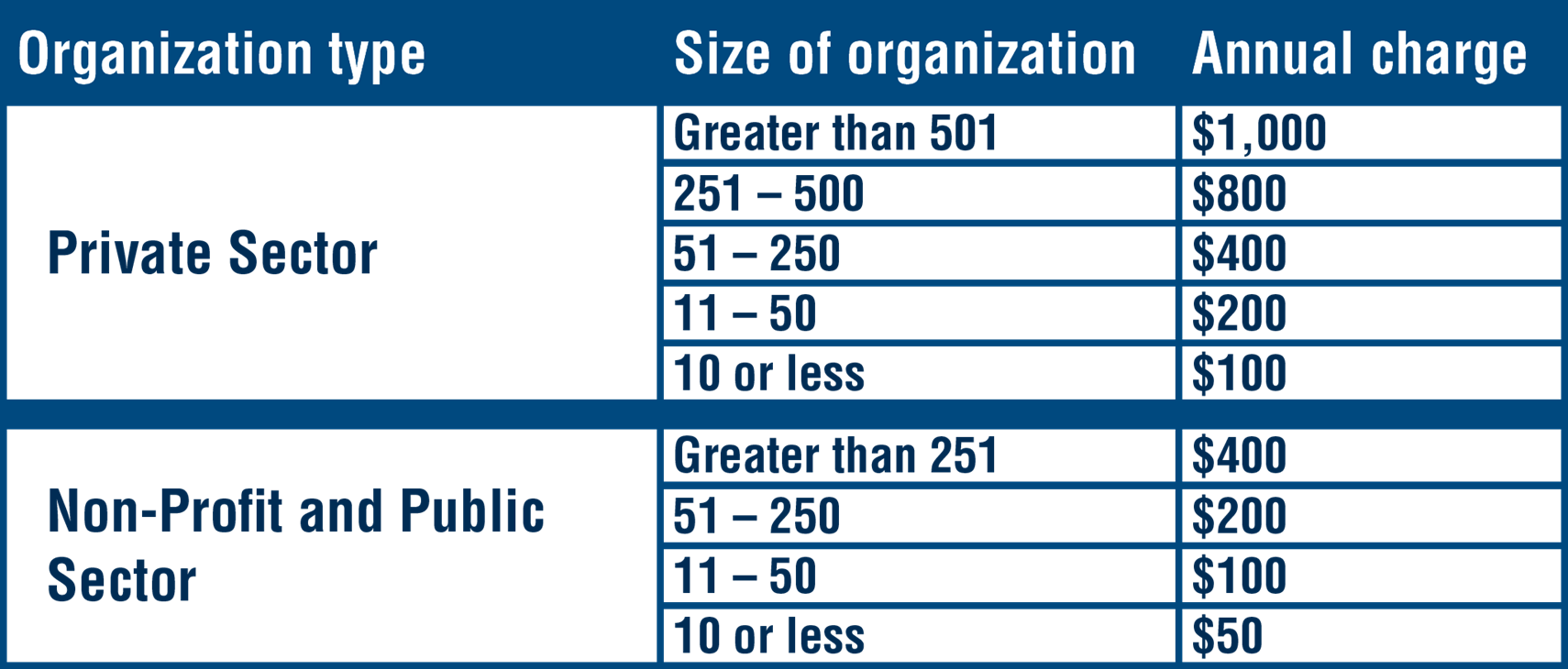

Once the details of the implementation plan are sorted, interested employers will sign the license agreement and pay the employer certification fee. The employer certification fee is very nominal and is dependent on the size of the organization:

At this point, the interested employer is officially recognized as a Certified Living Wage (CLW) Employer. The Program Manager will connect the CLW employer with the Living Wage Coordinator at United Way Niagara to arrange for the presentation of the Living Wage Employer Certificate. The OLWN and Living Wage Niagara will recognize the CLW employer through social media, events, and publications. The employer will be listed on the OLWN and Living Wage Niagara employer directory and map. Any job postings that the employer is listing can be posted on the Living Wage Niagara website and social media.

Each year on the anniversary of the certification, the OLWN Program Manager will send the CLW employer a renewal survey and invoice for the annual employer certification fee. When the living wage calculation is updated, the Program Manager contacts CLW Employers to let them know, and the wage is announced publicly. Employers have six months to adjust their rates once the new rate has been announced to continue to be recognized as a CLW Employer.

There are benefits to becoming a CLW Employer, such as improved business reputation, better relationships between management and staff, decreased employee turnover and absenteeism, increased retention and productivity, and savings on rehiring and retraining. Certified employers are committing to corporate social responsibility and directly addressing the sustainable development goals at the systemic level. Income is one of the most important determinants of people’s health, and a higher wage equates to healthier workers. This not only benefits the workers but enhances the employer’s reputation in the community as an employer who cares, which is a benefit in attracting and retaining workers, especially during a recession. Additionally, if an employee is paid a higher wage, they are less likely to leave the workplace or work more than one job, which means they are more productive and absent less often.

Overall, the living wage doubles as a tool that can be used in the employer’s recruitment strategy and as an effective poverty reduction strategy. Employers can invest in this tool as a way to improve working conditions which put employees in a position to provide better customer service. On the other hand, employees are able to enjoy life and participate in society more when they are paid a living wage. Employees can spend more time with family, save for an emergency, and not have to worry about affording basic necessities. The living wage is a win for all.